HOKIE: What is a synthetic asset

Decentralized finance on blockchain is becoming increasingly popular. Along with this popularity, new forms of assets have emerged to meet the needs of a wider user base. One of the most important categories of these new Assets is Synthetic Assets.

Synthetic assets are not a new invention in the field of blockchain. There are also many application cases in traditional finance. Next, we will first discuss the definition of synthetic assets from the perspective of traditional finance, and then study how synthetic assets can flourish in the blockchain industry.

Synthesis, as Defined by Investopedia, is the term for financial instruments designed to mimic other financial instruments while changing key characteristics, such as cycles and cash flows, and the resulting assets are derivatives. So a synthetic asset is made up of one or more derivatives that can be used to simulate the asset classes of other derivatives. In other words, the risks or returns of any financial instrument can be modeled using a combination of other financial instruments (synthetic assets).

What are synthetic assets

Typically, synthetic assets provide investors with a tailored model, duration, risk profile, etc., and are highly structured to suit their various needs. There are many different reasons behind creating synthetic positions:

• For example, synthetic positions can be taken to create the same returns as financial instruments that use other financial instruments.

• Traders may choose to create synthetic short positions using options because it is easier than borrowing shares and selling them short. Or a trader can use options to simulate a long position in a stock without having to put up money to actually buy the stock.

For example, you can create a synthetic option position by buying a call option and simultaneously selling a put option on the same stock. If the two options have the same strike price, say $45, the strategy is the same as buying the underlying security at $45 when the option expires. A call option gives the buyer the right to purchase the underlying asset at exercise, while a put option obligates the seller to purchase the underlying asset from the bearish buyer.

If the market price of the underlying asset is higher than the strike price, the call buyer exercises their option to purchase the underlying asset at $45, realizing a profit. On the other hand, if the price is below the strike price, the put buyer can buy the underlying asset for $45. A synthetic option position thus suffers the same fate as a real equity investment, but without the capital expenditure. This is a bullish trade, of course. The downside is seen by reversing two options (short calls and long puts).

Application of synthetic assets in blockchain industry

Most DeFi apps currently look much like traditional financial products, allowing users to exchange one token for another. But DeFi has much more potential than that. Blockchain is an open global platform whose core value lies in programmability. Synthetic assets are particularly well suited to tokenization. If a derivative is a financial contract that customizes exposure to an underlying asset or financial position, then a blockchain synthetic asset is a tokenized representation of a similar position.

In this way, blockchain synthetic assets have unique advantages:

• Extended assets

One of DeFi's biggest challenges is how to link real world assets in a trusted way. Fiat money is a good example. While it is possible to create a fiat backed stablecoin on the chain, as Tether did, there is another way to achieve the same effect by directly capturing the price of a synthetic asset against the dollar, without having to put the actual asset in the hands of a centralised counterparty. For most users, having a price is enough. Synthetic assets provide a viable mechanism for trading real-world assets on the chain.

• Improve liquidity

The main problem in DeFi right now is the lack of liquidity. Market makers can greatly influence the liquidity of the long Tail and published blockchain assets, but the financial tools for risk management are limited. More generally, synthetic assets and their derivatives can scale their businesses by hedging portfolios and protecting profits.

• Extended technology

Another issue facing DeFi is the technical limitations of current smart contract platforms. The problem of cross-chain communication has not been solved yet, which prevents many assets from entering a decentralized exchange. With synthetic assets, however, participants in a transaction do not need to own the assets directly.

• User expansion

While traditional synthetic assets are only open to large and experienced investors, smaller investors can also profit from synthetic assets on smart contract platforms with no barriers to entry, such as Ethereum. Synthetic assets allow more traditional investment managers to enter the DeFi space by adding to the risk management toolset.

Type of blockchain synthetic asset

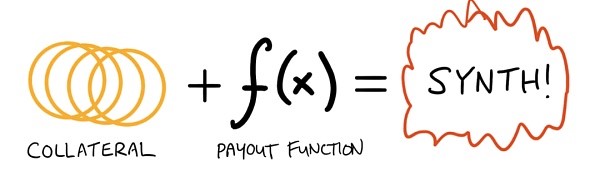

UMA protocol founder Hart Lambur divides blockchain synthetic assets into four types. First of all, synthetic assets can be summed up as: collateral and payout function are combined to create a synthetic asset.

Category 1: stablecoins or synthetic assets related to stablecoins. Maker's DAI is a synthetic asset designed to anchor $1, and all the staboins backed by illegal coins fall into this category, including more recently algorithm-based staboins (ESD, FEI, RAI, etc.). These types of synthetic staboins have obvious utility and there is demand for them.

Second category: synthetic assets related to cryptocurrencies. "Cryptocurrency-related synthetic assets" are defined as products that describe users trading, hedging and leveraging crypto assets. For example, competitive currency call options.

Third category: real world synthetic assets. Synthetic assets are often linked to real-world assets: synthetic gold, synthetic crude oil or the synthetic S&P 500 index.

Category 4: Unknown synthetic assets. Synthetic assets will give builders the ability to invent new assets that do not exist in traditional finance.

Although synthetic assets have become popular in the crypto space, their adoption rate is not high due to their complexity and high cost. As such, Injective has built a truly novel decentralized derivatives trading protocol that circumvents many of the existing problems. Not only do we provide an intuitive user interface, we can also provide a transaction agreement for 0 gas charges. Injective has partnerships with great synthetic asset agreements like UMA and Mirror, and is working together to bring new synthetic assets like uGas and ETH/BTC to the masses.

summary

Synthetic instruments are complex financial instruments that have repeatedly brought the global economy to its knees. Similarly, they may also pose risks to DeFi protocol security in ways we do not yet understand: smart contract risks, predictive machine risks, governance risks, etc. The industry is still in its infancy and we need more experimentation by developers before we can actually bring new financial products to market. To sum up, finding a balance between risk and potential will eventually lead to the maturity of the industry.